It has been known that gold has been manipulated, as investigated by GATA (Gold Anti-Trust Action committee), but as to why has been debated. But now it is clearly evident central banks have formed a gold cartel, and are flooding the market with gold.

The simple concept is that if you increase supply, you lower cost as you meet demand or surpass it. Now why would they flood the market with gold? Gold and fiat currencies are competitive because they are assets people usually invest it. If the dollar increases in value, gold will decrease in value, and visa versa. So if fiat currencies look strong like the US dollar (namely the dollar because it is the world's reserve currency), or the euro, the pound, the franc etc., they become more attractive for investors to invest in rather than gold.

Because of this, gold has been a barometer for inflation. If gold continues to become more expensive in said currency, it is a good indicator of the level inflation. However, by suppressing the gold price, gold becomes undervalued and the dollar becomes overvalued because people are investing in the dollar rather than gold, and since gold looks so weak the dollar looks strong.

Is this sinister or an act of necessity? Fiat currencies continue to depreciate, so it is a necessity to "keep the system going." The system is to have confidence in the international reserve currency; the dollar. All fiat currencies are based on confidence.

GATA, with many highly respected people on the committee and consultants such as Reg Howe, Frank Veneroso, James Turk, and John Embry, they provide a compelling case for their argument.

Trailer to Gold Rush 21.

Summery video from Gold Rush 21 - Part 1.

Summery video from Gold Rush 21 - Part 2.

Summery video from Gold Rush 21 - Part 3

The DVD was made back in 2005, but so far they have been right.

If we measure an ounce of gold back in the 1980, which would have been $850, from the CPI back when Jimmy Carter was president, gold's real price would be at $6,255 an ounce today. And if we measure by the CPI today, gold should be at $2,310 an ounce. What this shows is that gold is very much undervalued, and severely if we go by the CPI during Carter's administration (sourced from shadowstats.com).

Your income is supposed to adjust to inflation with the current fiat system, but I believe inflation is higher than being reported and therefore is not adjusting, but that is a different story. However, because currencies are depreciating, gold is becoming more and more attractive with investors. Many people in India and China invest in gold because they do not trust their government. In fact a lot of gold is not accounted for in China.

This certainly isn't good for the dollar when right now it is dependent on foreign investors. You can't defeat the market. They tried with the London gold pool, they tried distorting 10,000 tons out of Fort Knox under Nixon and Johnson, and they are doing it now more than ever. Central banks can't continue to do this forever. Central banks only have half the gold they say they have, and they probably won't get any of it back.

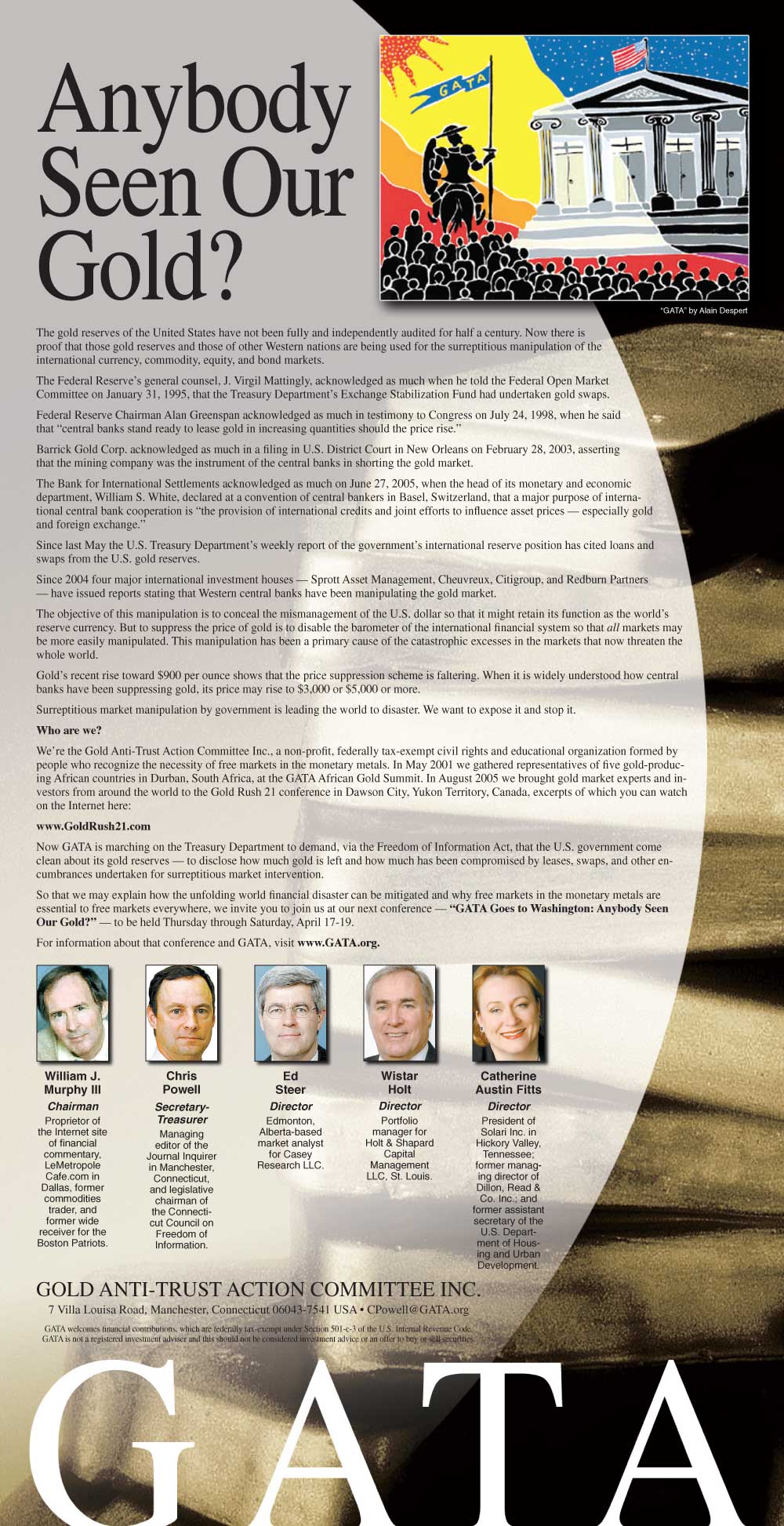

Yet they continue to deny this. GATA is facing many powerful people such as the US Gov and their big advertisers like Goldman Sachs, and JP Morgen. They payed the Wall Street Journal $264,426.2 to put in an ad, but not surprisingly the Wall Street Journal did not write an article about GATA.. But now they are taking their case to Washington, DC on April 17th using the Freedom of Information Act (FOIA).

This is their ad that was not published by the Wall Street Journal.

Gold is eventually going to explode in the future. It is a strong asset to invest in. If you would like to profit, I suggest getting your hands on physical gold. You can contact a local coin dealer, or can't find one or don't trust one, you can buy digital gold where a company stores the gold for you such as www.goldmoney.com and www.kitco.com.

At the time this DVD was made, gold was around $450 an ounce and is now currently $907. Gold is still cheap. However, if you are to invest, I would also invest in silver. Silver is called the poor man's gold, but it is sometimes called the smart man's gold. Silver has more industrial use than gold, and some say is has more potential than gold.

However, I'm not your financial adviser. If you have one you should contact one.

The simple concept is that if you increase supply, you lower cost as you meet demand or surpass it. Now why would they flood the market with gold? Gold and fiat currencies are competitive because they are assets people usually invest it. If the dollar increases in value, gold will decrease in value, and visa versa. So if fiat currencies look strong like the US dollar (namely the dollar because it is the world's reserve currency), or the euro, the pound, the franc etc., they become more attractive for investors to invest in rather than gold.

Because of this, gold has been a barometer for inflation. If gold continues to become more expensive in said currency, it is a good indicator of the level inflation. However, by suppressing the gold price, gold becomes undervalued and the dollar becomes overvalued because people are investing in the dollar rather than gold, and since gold looks so weak the dollar looks strong.

Is this sinister or an act of necessity? Fiat currencies continue to depreciate, so it is a necessity to "keep the system going." The system is to have confidence in the international reserve currency; the dollar. All fiat currencies are based on confidence.

GATA, with many highly respected people on the committee and consultants such as Reg Howe, Frank Veneroso, James Turk, and John Embry, they provide a compelling case for their argument.

Trailer to Gold Rush 21.

Summery video from Gold Rush 21 - Part 1.

Summery video from Gold Rush 21 - Part 2.

Summery video from Gold Rush 21 - Part 3

The DVD was made back in 2005, but so far they have been right.

If we measure an ounce of gold back in the 1980, which would have been $850, from the CPI back when Jimmy Carter was president, gold's real price would be at $6,255 an ounce today. And if we measure by the CPI today, gold should be at $2,310 an ounce. What this shows is that gold is very much undervalued, and severely if we go by the CPI during Carter's administration (sourced from shadowstats.com).

Your income is supposed to adjust to inflation with the current fiat system, but I believe inflation is higher than being reported and therefore is not adjusting, but that is a different story. However, because currencies are depreciating, gold is becoming more and more attractive with investors. Many people in India and China invest in gold because they do not trust their government. In fact a lot of gold is not accounted for in China.

This certainly isn't good for the dollar when right now it is dependent on foreign investors. You can't defeat the market. They tried with the London gold pool, they tried distorting 10,000 tons out of Fort Knox under Nixon and Johnson, and they are doing it now more than ever. Central banks can't continue to do this forever. Central banks only have half the gold they say they have, and they probably won't get any of it back.

Yet they continue to deny this. GATA is facing many powerful people such as the US Gov and their big advertisers like Goldman Sachs, and JP Morgen. They payed the Wall Street Journal $264,426.2 to put in an ad, but not surprisingly the Wall Street Journal did not write an article about GATA.. But now they are taking their case to Washington, DC on April 17th using the Freedom of Information Act (FOIA).

This is their ad that was not published by the Wall Street Journal.

Gold is eventually going to explode in the future. It is a strong asset to invest in. If you would like to profit, I suggest getting your hands on physical gold. You can contact a local coin dealer, or can't find one or don't trust one, you can buy digital gold where a company stores the gold for you such as www.goldmoney.com and www.kitco.com.

At the time this DVD was made, gold was around $450 an ounce and is now currently $907. Gold is still cheap. However, if you are to invest, I would also invest in silver. Silver is called the poor man's gold, but it is sometimes called the smart man's gold. Silver has more industrial use than gold, and some say is has more potential than gold.

However, I'm not your financial adviser. If you have one you should contact one.