@A: Obviously. So the 80s were not a recession, but the largest peacetime expansion of the United States, right?JohnG@lt wrote:

A) Jobs are always created during non-recessions. We're in a recession, job losses are to be expected.Harmor wrote:

Do you agree that Regan's policies create 35 million more jobs? It also stopped the stagflation from the Carter Administration?

You can't dispute that can you? But that's ok...the 8 million less jobs we have under Obama is the direction we want to continue, right?

B) I dislike Obama, probably more than you do, but for rational reasons, not because I'm a member of the Red Team.

C) This thread is about the Republican Party picking economic idiots as their leader. O'Donnell, Palin, both certainly qualify. But keep trotting out Reagans corpse and telling yourself that the Tea Party stands for anything more than social conservatism at this point. That was proven in Delaware.

@B: Good, we both dislike Obama's policies.

@C: Social issues aren't as important now when you have this kind of economy. When times are good, you're right, social issues would definiately be more of a campaign issue than economic issues. Remember Clinton and "Its the Economy Stupid?" campaign slogan?

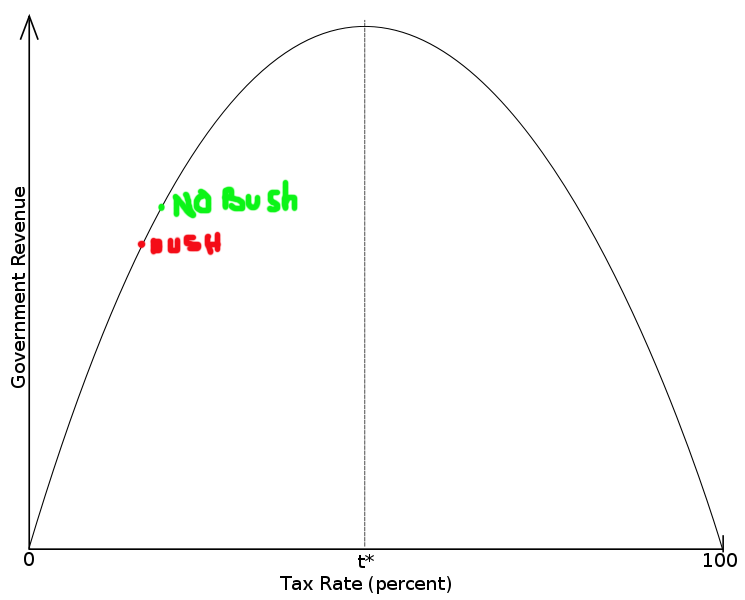

So supporting candiates that want to lower taxes is means that they are idiotic? You know you can pay more to the IRS then what they say you should pay? The private sector will to alot better in pulling up out of this recession that having the government spend the money on stimulus fund (need I remind you that we recently spent $2 million per stimulus job here in L.A?).

I guess Conservaties will `trot` on Regan's corpse while Liberials have been `trotting` on Roosevelt's corpse for decades now. I guess its only fitting that everyone has a hero to look up to.

As an aside, I want to thank you JohnG@lt. Its not often I get into a these kind of debates - its rare for me. But you're doing me a favor by learning to defend Conservative principles against Liberal attacks. You're really are helping me get my ducks in a row in formulating my arguments to Liberal counter arguments. And also allowed me to research some bills and programs that did in fact have some unintended consequences, I'll give you that.

+1